Democratizing Access: Inclusion Through Fintech

Mobile wallets teach money management with instant balances, spending categories, and savings jars. For people moving from cash, seeing every transaction mapped to a category accelerates understanding of where money goes and how small amounts add up quickly.

Democratizing Access: Inclusion Through Fintech

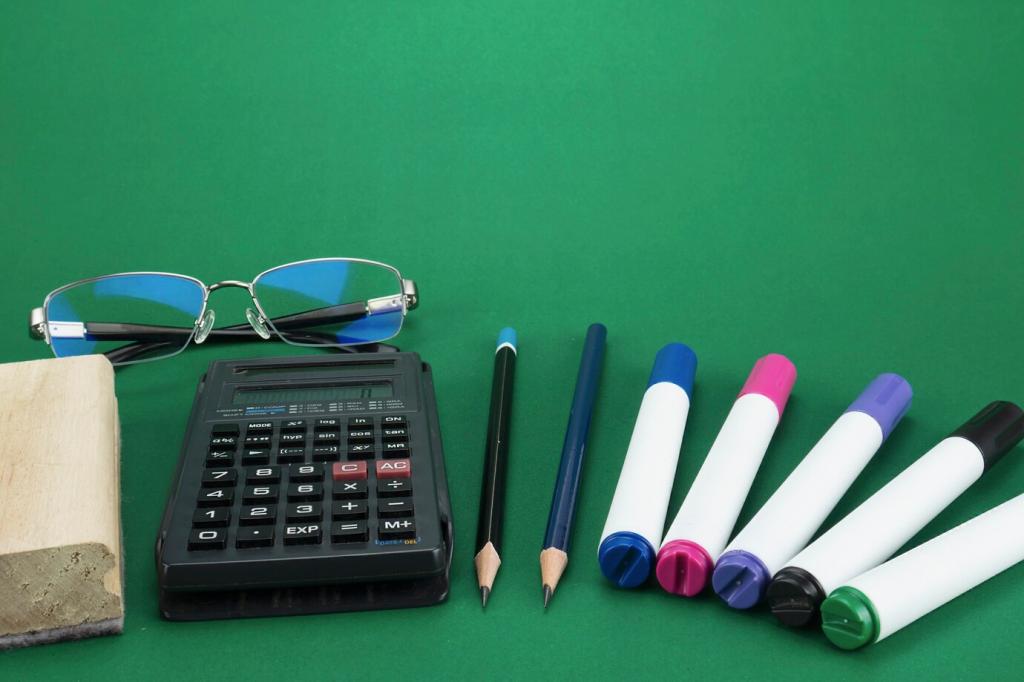

Transparent fee breakdowns and real-time exchange rates help senders and receivers learn to compare costs across providers. Side-by-side calculators turn what used to be guesswork into a small lesson on fees, timing, and choosing reliable, fair-value options.

Democratizing Access: Inclusion Through Fintech

When connectivity is limited, offline modes and SMS summaries still teach essential lessons. One farmer’s group used weekly message reports to compare seed expenses and plan community bulk purchases, transforming literacy into shared action and better margins.